Give a gift that matters

Free accounts for online gifting

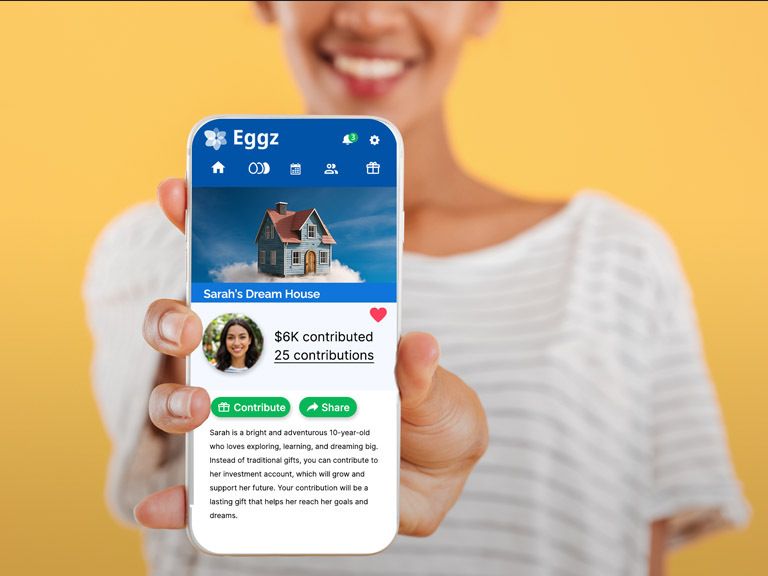

People want their gifts to mean something. Birthdays, weddings, and other events let friends and family share messages, photos, or videos with their contribution, creating a digital “scrapbook”.

Elsa Hampton

I love you Hannah! Happy Birthday!

Grandma

Sue Scannel

Congratulations from all of us!

John & Sue

Paul Catalan

Graduating? I remember his first steps!

Uncle Paul

What's your goal?

Saving for

retirement

Being smart

with my money

Gifting that makes

a difference

Investing can be easy

Grow your money

Expertly Curated Funds

Choose your Investment Style

Finally I am investing

my money

Only $5

a month

Yes!

Can you manage

my money?

We’ll guide you through creating an Egg and setting up your investment account.

Invest your money with the expertise of top-rated financial advisors for only $5 a month.

Our experts designed five diverse portfolios combining stocks, bonds, and ETFs from top firms like Vanguard and BlackRock. Accounts over $3,000 switch from $5/month to standard AUM fees.

Once your account value exceeds $3,000 you switch from $5 a month to standard AUM fees.

AVG

RETURN

4.9%

± 6%*

Conservative

Lower potential returns with steady and predictable performance.

Typical Portfolio

- Stocks: 10% — 30%

- Bonds: 50% — 70%

- Cash: 10% — 30%

AVG

RETURN

5.4%

± 9%*

Moderately Conservative

Steady potential returns with minimal ups and downs.

Typical Portfolio

- Stocks: 30% — 50%

- Bonds: 40% — 60%

- Cash: 5% — 15%

AVG

RETURN

5.7%

± 10%*

Moderate

Steady potential returns with some movement in value.

Typical Portfolio

- Stocks: 50% — 65%

- Bonds: 30% — 45%

- Cash: 5% — 10%

AVG

RETURN

6.3%

± 13%*

Moderately Aggressive

Higher potential returns with some fluctuations in value.

Typical Portfolio

- Stocks: 70% — 85%

- Bonds: 10% — 25%

- Cash: 2% — 5%

AVG

RETURN

7%

± 17%*

Aggressive

Highest potential returns with fluctuations in value.

Typical Portfolio

- Stocks: 85% — 100%

- Bonds: 0% — 10%

- Cash: 0% — 5%

* Standard deviation from the average potential return

- Conservative

- Moderately Conservative

- Moderate

- Moderately Aggressive

- Aggressive

Estimate your Eggz Potential

From you, friends, and family

Growth

In the last 5 years average 6-8% Compound Annual Growth Rate (CAGR)

POTENTIAL EGG VALUE

This chart estimates how your investment could grow over time based on the starting amount, the contributions by yourself and friends and family, the time frame, and the investment style you chose. Adjusting these inputs will change the results. Try different numbers to explore what's possible. These projections are not predictions of any Eggz investment and don't factor in market ups and downs or other real-world conditions that can affect returns.

Invite your Flock

Share the wealth with family and friends

Investing finally feels easy

Expertly curated investment

funds managed for you

Advisory services offered through Eggz, an SEC-registered investment adviser. Investing involves risk, including loss of principal. Past performance does not guarantee future results. Brokerage products and services are provided by Alpaca Securities, LLC, an SEC registered Broker Dealer, Member FINRA/SIPC. Investment products are NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE. View additional investing disclosures.